Dealerships that don’t Honor Car Internet Price

They are not all the same but if you’ve shopped the internet long enough you’ve come across a dealership or dealer price that isn’t honoring internet price that is listed on either their own website or another car site like cars.com.

Ever hear of it?

Yeah, me too.

Even as a professional car buying concierge and a professional negotiator, I’m not sure why, but I still ask the question “So, are you saying that you are not honoring the internet price?” when I’m talking to a salesman.

The question remains. Does a car dealership have to honor an online price especially when it’s a dealer ad?

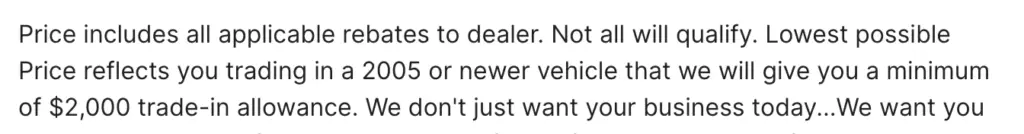

Most of the time, there is specific small print language within their ads that explains what is missing from the online price. And there is definitely small print on their website explaining the price.

Terms such as “lowest possible price” are sometimes used, as seen in strategies employed by companies like Subaru. These disclaimers serve as a protective measure for dealerships, allowing them to adjust prices due to various factors.

For consumers, understanding these tactics can be crucial. It highlights the importance of clear communication with the dealership regarding the advertised price versus the actual cost at the dealership.

Subaru uses the term “lowest possible price” when describing their list price.

Here’s an excerpt from a dealership site.

Internet car sales price

Internet car prices often serve as a starting point for negotiations, but they can exclude several components that impact the final cost. Advertised prices usually account for various rebates; however, buyers seldom qualify for all available rebates at once.

This makes achieving the advertised “lowest price” quite uncommon. Moreover, additional criteria such as trading in an old vehicle are often prerequisites for certain discounts.

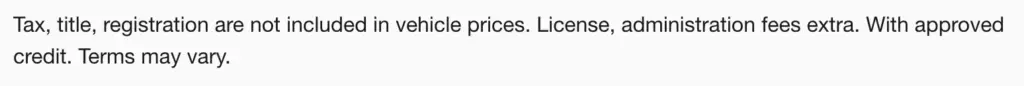

Consumers should also be aware of other unavoidable fees not covered in the initial online listing, such as tax, title, and registration. These elements collectively highlight the complexity involved in understanding the true car prices when purchasing from a dealership. The internet car sales price doesn’t include a lot of the things that are added on later (for obvious reason).

When the dealership website states that the price includes all applicable rebates; we need to be aware as consumers that we cannot qualify for all of the rebates.

I’ve actually never seen it happen where someone qualifies for every rebate offered. They are never easily combined. So, even calling it a lowest “possible” price seems unrealistic. It’s actually not possible at all.

There are also some other requirements you must meet including selling a trade-in.

Administration and Doc Fees

What are administration fees? They are hard to define. Administration fees, also known as doc fees or documentation charges, are generally intended to boost dealership profit margins. While they vary across dealerships, these charges can obscure the actual cost of a car. Regardless of what it is called (these fees vary from dealership to dealership), it’s simply a profit center for the dealership.

When reviewing a deal, potential buyers should also consider taxes, the interest rate on financing, any trade-in value, and opportunities for negotiating a better interest rate.

Common Practice of Advertising Undeliverable Prices

Many dealers advertise a price they have no intention of delivering on.

I see this all the time.

Just like you, I use car search sites like Car Gurus, Auto Trader, Cars.com and search for the vehicles my client’s have tasked me to find.

I enter the make, model, trim, color, miles and any other feature needed.

Then the trouble comes. You sort it by price. This practice takes advantage of how consumers typically use these websites to find the best deals.

The low price displayed may attract attention, but it often omits crucial details. The expectation of a bargain can be misleading, acting as a bait-and-switch tactic. These prices may not reflect additional costs buried in the fine print, leaving us surprised when we attempt to finalize a purchase.

The dealers price is set to what they want to SHOW you. This is not necessarily the price they are willing to sell the vehicle for.

They simply understand the way consumers are searching and/or sorting. By PRICE.

The price they SHOW you is not the entire picture.

Then, the car research website may even tell you that the vehicle you’ve found (at the top of the list) is a great deal.

Right?

Well… maybe, or maybe not.

Chances are, the great deal advertised (much lower than everyone else) may not be giving you the entire picture.

A typical consumer sees an advertised price—for example, $14,840—and may perceive it as a bargain. It is easy to focus on the advertised payment terms without fully comprehending the overall cost. This can lead to situations where buyers spend a significant amount of time at the dealership, only to learn that the final numbers deviate from their initial expectations.

Internet Price Online Quote

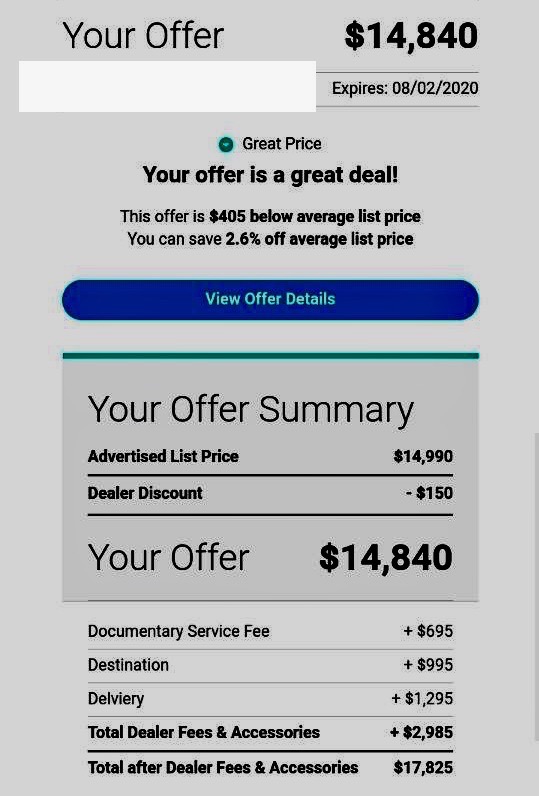

Now look at this online offer.

This quote, from a large online lead generation tool for dealerships (and your car research site), shows that this is a great deal.

The offer is $405 dollars below the average list price.

The keyword in that sentence is list price.

What is the $2,985 in dealer fees and accessories?

That eats up the $405 dollars quick, right?

It also wasn’t easy for me to find the breakdown of these additional fees.

You have to know where to look to find it.

You have to actually reach out to the dealership in a lot of cases. Some dealerships do not disclose these fees anywhere online. If they do, they are rarely out in the open. Therefore, you’ll need to scroll down, open another window or find the smaller print.

The average consumer only sees the price of $14,840 for the car and thinks it is a great deal.

They spend their time visiting the dealership and fall in love with the car. When the numbers are presented, the focus is set on the payment not revealing the actual cost of the car.

Consumers who spend hours at the dealership, accept the fact of the car dealer not honoring internet price. They accept it because they don’t want to go through the whole ordeal again somewhere else.

The dealer charged more than the advertised price. Simple as that.

A car dealer not honoring internet price should, in this day and age, be nothing new. In fact, the point of this post is to inform you what to look for when you’re doing your car research online.

The dealerships use the internet for one thing, to find a way to get you into the dealership.

You’re doing your research, so be aware, it’s highly unlikely a dealership will honor that internet price you see. Assume some added costs especially tax, title, tags are not included in the price you are seeing on the dealer’s website or cars.com.

You also need to call the dealership to get a real breakdown of the deal, any dealer add on’s and preferably get it in writing before you even visit.

I rarely recommend negotiating at the dealership.

Good luck out there. Tell us in the comments if you find a dealership that honors the actual online price, we’d love to know so we can work with them!

Frequently Asked Questions

“Internet pricing” for cars at dealerships refers to the pricing strategy that dealerships use when advertising and selling vehicles online. There are a lot of issues with internet pricing on free car buying sites because the prices set are typically not the price that dealerships deliver on when you go to their dealership.

Once a dealership gets you in the door, you are less likely to go anywhere else. Dealers’ best tactics are to get you to spend time sitting in the vehicle, test driving, sitting at the sales desks, where you waste and invest a lot of your time and day. This breaks a lot of consumers down so they overlook a lot of sales tactics like a lower online price that turns out to be much higher. Often dealers will list low prices or mystery vehicles that don’t even exist on the lot. When you get there you find out that the vehicle is “sold” or no longer there.

If you want the best price or deal you need to make dealers compete. It would take a lot of time if you visited 4-5 dealerships to get pricing on a vehicle. That’s why we recommend that you locate 4-5 dealers with the vehicle you want to purchase and contact each of them to get a buyer’s order. Once you do that, you can see the difference in price between each dealer. You can then begin to negotiate so that you know what to expect to pay and can do your due diligence. If you don’t contact more than one dealership and simply walk on the lot, you cannot know if you’re getting the “best” deal you can get because you haven’t made dealerships compete.

Simply walk away and find a dealer that will be upfront and transparent with their pricing. You can also leave a review so others know what to expect.

Doc fees or documentation fees are simply profit centers for dealerships and each dealership can have a different fee. Some states have max doc fees set.

Rebates and incentives are often advertised to everyone but the fine print will often disclose who or in what situation the incentive or rebate can be applied to. Additionally, you can’t usually combine incentives or rebates. It’s usually a one or another offer but advertisements won’t typically disclose that up front to get you in the door.

Ask for a buyer’s order which should detail out the total price of the vehicle. Ask for the out the door number with tax, title and fees included. You can ask for this information over the phone, there is no reason you need to visit the dealership to get the total price of a vehicle. But be prepared for dealerships to try to get you to come in to give you that information.

To know the total cost of a vehicle, you must get a buyer’s order from the dealership. There is no percentage or estimated amount that one can guess or say based on a posted internet price.

Every dealership no matter the make or model has fees.

Some listings or advertisements may claim a particular payment or price and it could be only for particular buyers or incentives for those with specific qualifications. Reading fine print will help but talking specifically to the dealer is necessary to get the actual pricing details.

You need to call the dealership who is listing the vehicle and ask for a breakdown of the pricing of the vehicle. You can ask for a buyer’s order or a menu as it’s called by some dealerships.

Call them and ask them to send you a buyer’s order by email or even text message. Transparent and upfront dealers will send it to you without a problem. Those who refuse to send that information want you to come into the dealership. That’s a bit of a red flag.

The purpose of listing a lower internet price for dealerships is to attract consumers to their dealership. If they can get you to the dealership spending your time there at length, it is highly unlikely you will want to go anywhere else and spend more time doing the same. It’s just a marketing ploy. When a dealership lists a price lower than everyone else, they are aiming to show up first in the list of vehicles sorted by low price. They get more eyeballs, and likely more customers that way.

Taxes, title, documentation fees and any dealer markups, addendums they choose to add are not included in internet prices.